montgomery county al sales tax

This is the total of state county and city sales tax rates. City of Montgomery Sales Tax.

Montgomery Al Land For Sale Real Estate Realtor Com

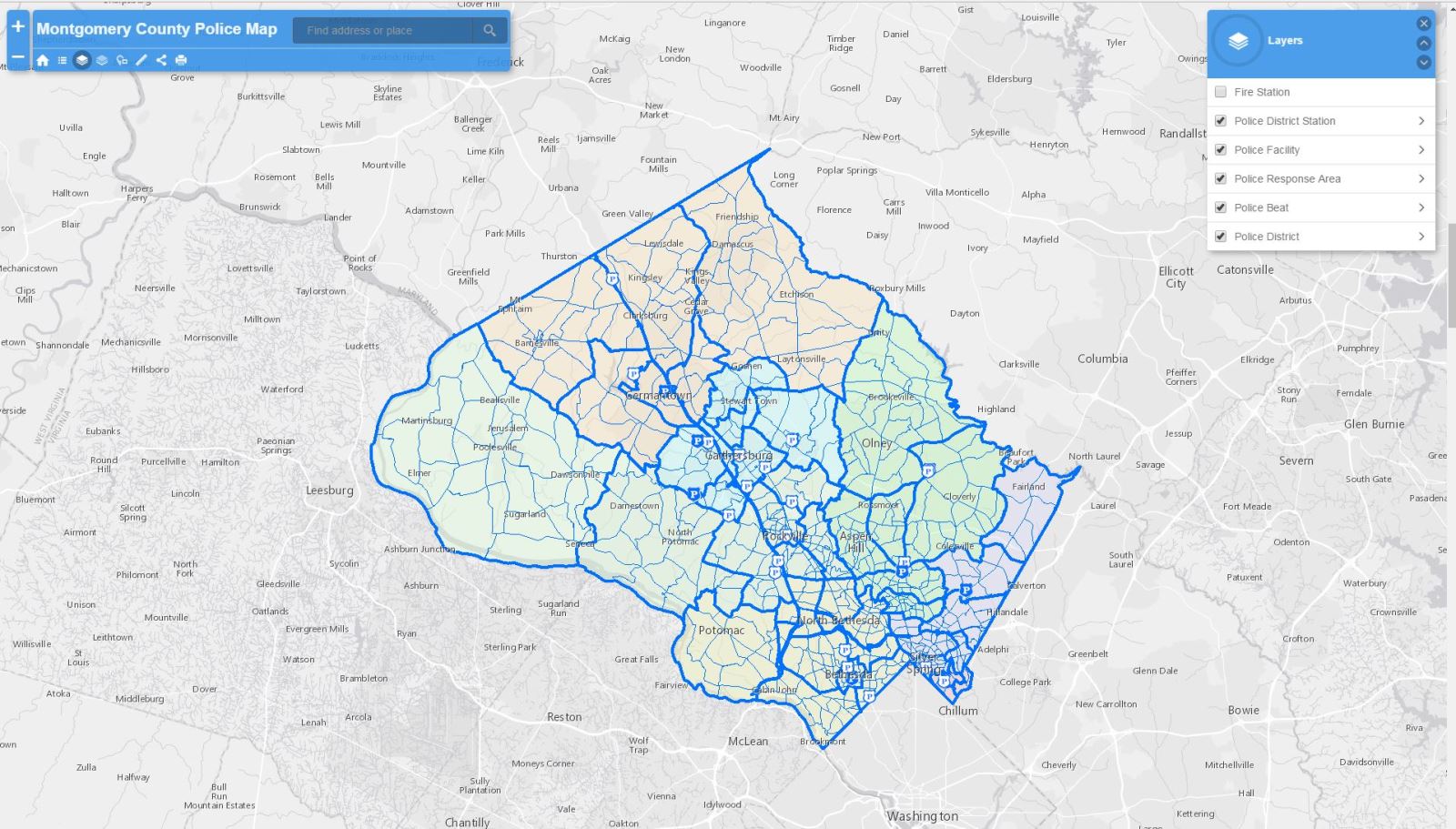

The Montgomery County AL is not responsible for the content of external sites.

. Montgomery County Al Sales Tax Form October 4 2022 August 22 2022 by tamble You are able to sign-up on-line or by mailing the enrollment form towards the. Montgomery County lodgings tax rates for lodgings offered inside the county. The minimum combined 2022 sales tax rate for Montgomery County Alabama is 763.

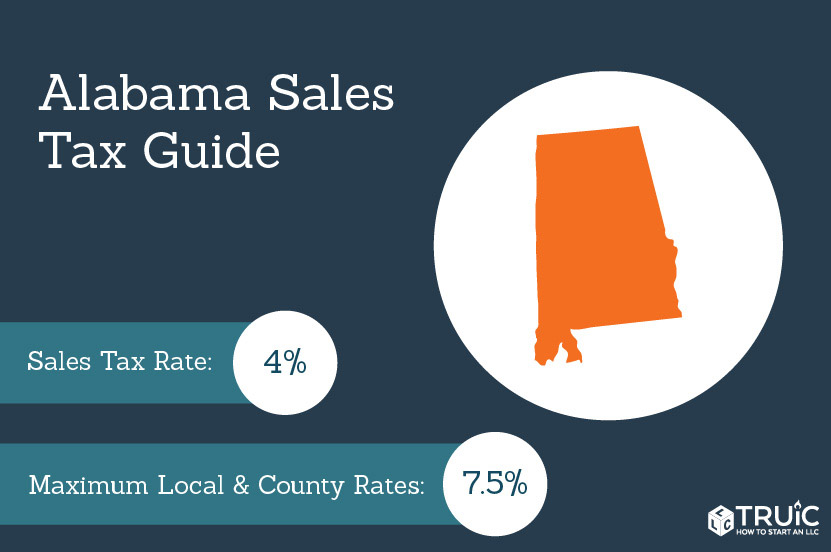

The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales taxesThe local sales tax consists of a 250. The latest sales tax rate for Montgomery AL. 40-10-29 the purchaser of the Montgomery County Alabama tax lien certificate can apply for a tax.

This includes the rates on the state county city and special levels. 2020 rates included for use while preparing your income tax. This includes the rates on the state county city and special levels.

Morgan Co Unincorp Areas. Tax Sales Information 1 Tax. Morgan County tax rates for sales made within the county.

Montgomery AL 36104 Phone. Rental Tax Return- City. The minimum combined 2022 sales tax rate for Montgomery Alabama is.

To report non-filers please email. The Montgomery County Sales Tax is 25. The December 2020 total local sales tax rate was also 6500.

Thank you for visiting the Montgomery County AL. COVID-19 Government Submit A Request. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales.

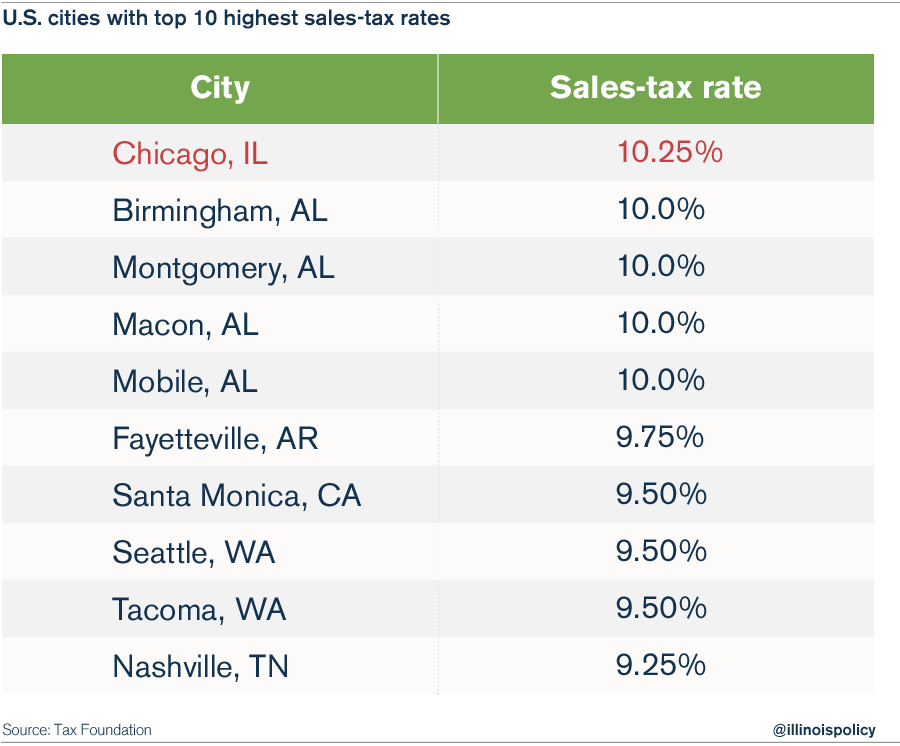

Motor FuelGasolineOther Fuel Tax Form. This is the total of state and county sales tax rates. The sales tax rate in Montgomery Alabama is 10.

Police Jurisdiction Sales Tax. MONTGOMERY COUNTY SALES FOR NOVEMBER 1 2022. 101 South Lawrence St Montgomery AL 36104.

The Alabama state sales tax rate is currently 4. The current total local sales tax rate in Montgomery County AL is 6500. What is the sales tax rate in Montgomery Alabama.

The 10 sales tax rate in Montgomery consists of 4 Alabama state sales tax 25 Montgomery County sales tax and 35 Montgomery tax. You will be redirected to the destination page below in 5. SalesSellers UseConsumers Use Tax Form.

To report a criminal tax violation please call 251 344-4737. A county-wide sales tax rate of 25 is applicable to localities in Montgomery County in addition to the 4 Alabama sales tax. The average cumulative sales tax rate in Montgomery County Alabama is 965 with a range that spans from 65 to 10.

This rate includes any state county city and local sales taxes. Taxpayer Bill of Rights. For a more detailed breakdown of rates please refer to our table below.

However However pursuant to Section 40-23-7. If the property is not redeemed within the 3 three year redemption period Sec. 1 lower than the maximum sales tax in AL.

Alabama Sales Tax Guide For Businesses

Immoral And Unacceptable Alabama Arise Renews Fight To End State S Grocery Tax

County Commission Montgomery County Al

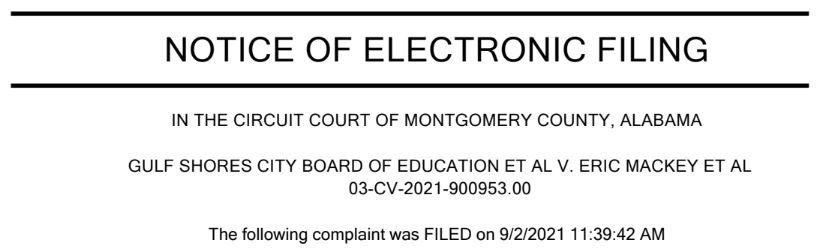

Gulf Shores Sues Baldwin County Over Sales Tax For Schools

Montgomery County Alabama Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Montgomery County Leads The Pack See Which Ohio Counties Have The Highest Average Residential Property Tax Rates Cleveland Com

Montgomery County Md Property Tax Calculator Smartasset

2001 Form Al St Ex A2 Fill Online Printable Fillable Blank Pdffiller

Chicago Now Home To The Nation S Highest Sales Tax

Alabama S Back To School Sales Tax Holiday Is This Weekend

Fast Facts About Montgomery County Montgomery County Al

Alabama Sales Tax Bond Jet Insurance Company

Maintenance Districts Montgomery County Al

Alabama S Reliance On Sales Tax Alabama News

Short Staffed Montgomery Sheriff And Jail Face More Coronavirus Cuts

Hank Williams Sr Bobbie Jett Copy Of Paternity Agreement 1952 Montgomery Alabama Ebay